Central Bank Digital Currencies (English)

The number of countries and central banks that have expressed their interest in so called Central Bank Digital Currencies (CBDC) has steadily increased over the past few months, among which are Norway, Switzerland, India, and China. What is a CBDC? And why would central banks and international organizations like to develop their own digital currency?

Types of money

To understand the possible purpose of a CBDC, we’ll first have to learn about the different types of money.

It all starts at the central bank. Central banks issue the coins and banknotes that we’ve all gotten familiar with. The European Central Bank (ECB) fulfills this role in the European Union, and the United States has the Federal Reserve (Fed) to print new dollars.

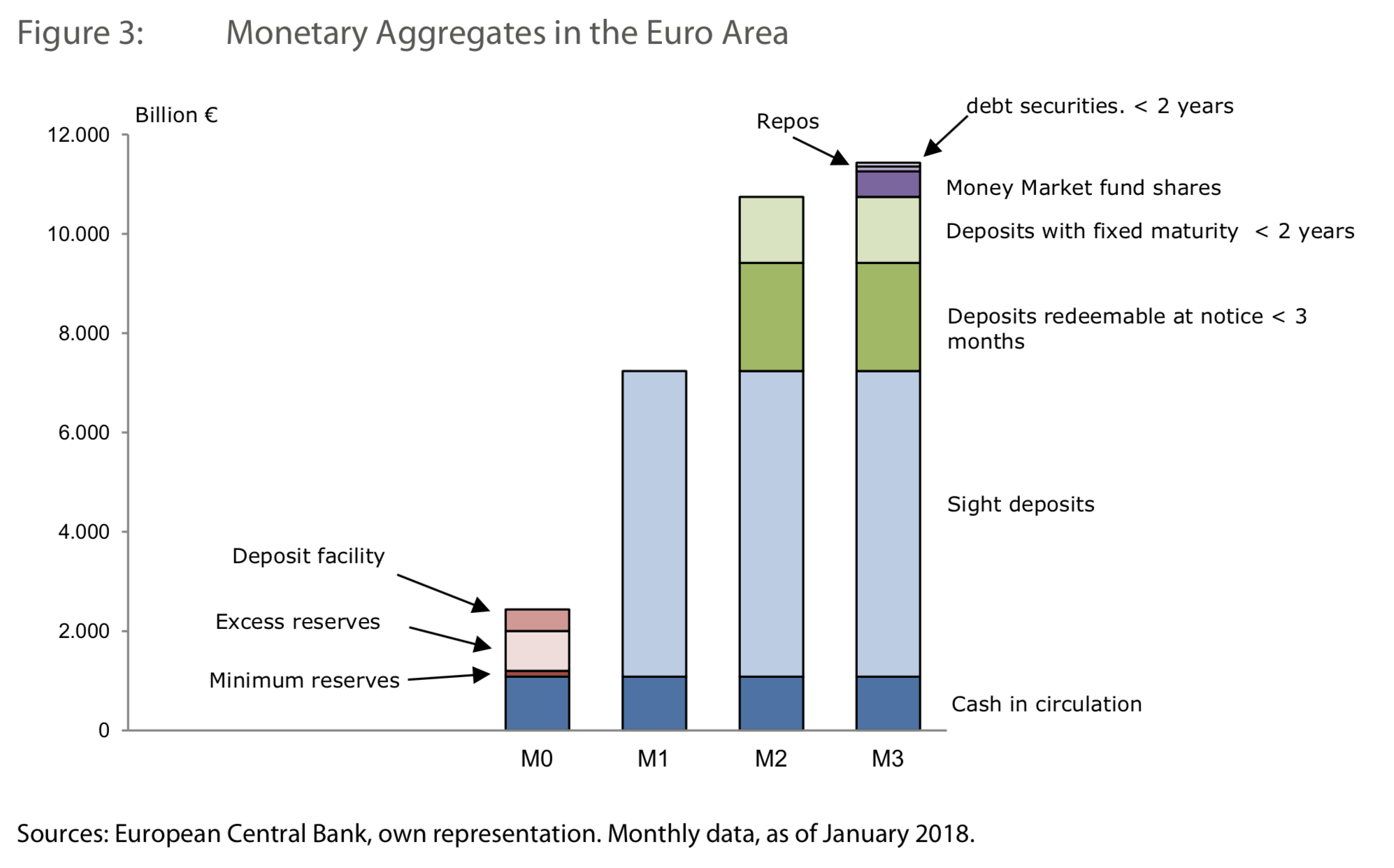

In economics, the money supply is the total value of monetary assets available in an economy at a specific time. There is no single correct measure of the money supply. Instead, there are several measures, classified along a spectrum between narrow and broad so called monetary aggregates. The different types of money are typically classified as "M"s. The "M"s usually range from M0 (narrowest) to M3 (broadest).

M0 is the sum of all notes and coins brought into circulation by the aforementioned central banks. In some countries people refer to M0 as monetary base, or narrow money. If you add all traveler’s checks, all checkable deposits, and all funds held in demand deposit accounts in commercial banks you’ll get M1.

As you can see, there’s a large gap between M0 and M1. The difference is caused by banks that create money with a simple press of a button. This type of money creation is called fractional-reserve banking. It’s based on the assumption that people don’t withdraw all of their money at the same time, and that keeping only a fraction of the deposits as reserve is enough to keep the system running.

Bank run

But what would happen if everybody went to the bank and tried to get their cash out at the same time? This is what we call a bank run.

A bank run occurs when a large number of people withdraw their money from a bank, because they believe the bank may cease to function in the near future. As a bank run progresses, it generates its own momentum. As more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy.

A banking panic is a financial crisis that occurs when many banks suffer bank runs at the same time, as people suddenly try to convert their threatened deposits into cash or try to get out of their domestic banking system altogether. A systemic banking crisis is one where all or almost all of the banking capital in a country is wiped out.

In case of a bank run, some of your money may be accounted for by a deposit insurance. It is a measure implemented in many countries to protect bank depositors (in full or in part) from losses caused by a bank's inability to pay its debts when due.

Nevertheless, storing your precious money on a bank account carries the risk of losing it altogether. In the past 10 years hundreds of banks and insurers went bankrupt or were bailed out. Why would anyone take that risk, given that you don’t get interest on your money anyway?

Well, simply because the only alternative is to withdraw your money and hide it under your mattress, prone to get stolen or burned. A risk as well.

Central Bank Digital Currencies

But what if central banks would issue a new type of money? Digital, just like the money you deposited into your bank account. As opposed to commercial bank money it would always be redeemable for cash at the central bank.

The European Parliament has recently published an in-depth analysis on digital currencies. It explains what CBDC’s are and how they work:

With the introduction of Fedcoins, households and businesses would be enabled to hold non-tangible central bank money, i.e. direct claims against the central bank. (source)

The logical follow-up question would be why anyone would still deposit money into commercial banks?

So far, in the Euro area more than 80 percent of monetary aggregate M1 are sight deposits. As soon as holding and transferring money on CBDC accounts is convenient, safe and frictionless, a growing number of people and businesses would probably prefer to hold liquidity in their CBDC accounts. As a consequence, commercial banks would increasingly lose the ability to attract deposits. (source)

If a CBDC was suddenly introduced, it may have the same effect as a bank run. Exchanging your bank account balances to CBDC’s is similar to withdrawing your money at an ATM. Without long queues…

The Dutch central bank states the following:

We do, however, maintain a critical stance towards CBDC, in view of the uncertainties and risks attached. CBDC would for example initially compete with bank deposits, raising the cost of bank funding and undermining banks’ capacity to extend credit. Moreover, in the event of a crisis, CBDC may exacerbate a bank run. (source)

In summary, CBDC’s should be introduced cautiously and gradually, because the expectation is that people rather want CBDC’s than money on a bank account.

Full reserve system

Banks earn a lot from fractional banking right now. For every euro or dollar on a savings account they can create a multiple in new loans. The trick is that they don’t lend out the actual savings, but just use it as reserve to be able to create much more new money. Banks buy new money from central banks at a discount, and use that money for mortgages, credit cards, and business loans.

As a consequence, commercial banks would increasingly lose the ability to attract deposits. So far, sight deposits have been a major and reliable source of funding for commercial banks. In fact, an integral part of the business model of banks consists of collecting short-run deposits and granting long-run loans (maturity transformation). If a substantial share of depositors transferred their money to CBDC accounts, the fractional reserve banking system would be challenged at its core. (bron)

That source of income is jeopardized if people would convert their bank deposits to CBDC’s. Quickly banks wouldn’t be able to meet capital and liquidity requirements. On top of that, these requirements would become more strict as a result of increased inflow and outflow of money.

The current fractional system could be replaced by a full reserve system in which banks wouldn’t be able to lend out more than they have in their reserves.

Banks would have to earn their money in different ways. They’d have to increase the fees for the use of debit cards, credit cards, mortgages, insurances, and other financial products. Maybe even beyond what people are willing to pay.

More power to central banks

It also means that the central banks themselves will create more money, instead of the commercial banks, and that the central banks will earn more money and gain more control over this aspect of the monetary system.

Second, with less bank deposits and more CBDC units in use, base money would increase sharply and permanently. Due to this major increase of the monetary base, the government sector would generate higher revenues from money creation (at the expense of commercial banks). Moreover, the central bank could better exercise control over monetary aggregates. (source)

And that is an interesting point. Because it isn’t the government that runs the central banks. Most central banks have private owners or are managed by a private board of directors.

But apart from that, what could a central bank do with that power?

A problem with cash money is that the interest rate can’t drop below zero. If a bank pays negative interest (i.e. you pay the bank for using your money), it becomes interesting to simply withdraw that money and keep it as cash.

The advantage of digital money (such as cryptocurrency and CBDC’s) is that you can integrate negative interest rates into the rules of the blockchain or smart contracts.

This gives central banks an instrument to punish people for not spending their money. They want to force people to spend their money, a policy that’s necessary to be able to steer inflation, for example.

The Dutch economist Willem Buiter, former member of the interest committee of the British central bank and nowadays chief economist of Citibank, sees as the problem of cash that the central banks can not reduce their interest rates below 0. According to Buiter, negative interest rates of, for example, -5 or even -10 percent are required. In other words, Buiter wants a policy to confiscate 10 percent of the value of your savings and the purchasing power of your euro each year. (source)

Down the rabbit hole

You could still view this as a legitimate reason, because conducting monetary policy is a task for governments and central banks.

Another effect of digital money is gaining insight into spending patterns and money flows at the individual level. Fun for tax authorities and companies that earn money by knowing you. Take a search on Google for "cashless society" and "war on cash" to read more about the dangers and risks of a situation in which a government is in possession of such information.

A different scenario is that a central bank can switch from one currency to another at once using digital money. For example, it could switch from the current (bankrupt) dollar to a new gold backed dollar, as Jim Rickards describes in his book "Currency Wars".

Or the transition from the euro, dollar and yen to one single global currency, such as the SDR created by the IMF. The SDR could take over the monopoly of the dollar as the global reserve currency, shifting the power of the United States to international organizations such as the IMF and the BIS. Willem Middelkoop describes this scenario in his book "The Big Reset".

If you think this is a farfetched scenario, think again. The IMF in its own report:

New technologies could help kick start broader adoption of the SDR if more fundamental challenges facing the SDR can be overcome. (source)

Mark Carney, governor of the central bank of the United Kingdom, made the case for a new global financial system in a speech two weeks ago:

The UK has been at the forefront of G20 reforms to create a global financial system that is safer, simpler and fairer. Implementation is now being regularly assessed and transparently reported by the FSB and the IMF. (source)

What that financial system would look like? It may be built upon CBDC’s:

In anticipation, the Bank is already creating the new hard and soft infrastructure that the new finance will require. (...)

First, RTGS is being re-built so that new private payment systems, including those using distributed ledger, can simply plug into our system. (...)

No longer will access to central bank money be the exclusive preserve of banks. (source)

This gives us an impression of how he wants to introduce these fundamental changes. His speech is titled "New Economy, New Finance, New Bank". It’ll be a new era, and it calls for a new economy, a new financial system and a new role for banks.

How are people going to buy this?

In two ways.

Firstly by not calling out the aforementioned scenarios. The chapter on CBDC in the report of the European Parliament ends as follows:

Overall, a digital currency issued by a central bank can be disruptive and bears a challenge to the fractional reserve system. The current banking system, based on fractional reserves, would be challenged at its core, as soon as market participants increasingly held liquidity in the form of the new digital currency instead of bank deposits. To avoid recurrent instability of the banking system, commercial banks would probably be required to come up with more reliable funding sources to replace deposits. As the fractional reserve character of the current banking system can be a major source of instability, such a disruptive change due to the introduction of a CBDC is not necessarily a bad development, but instead could finally pave the way for a more stable financial system. (source)

In other words, use the negative sentiment among the public about banks. The banks have cost billions, and the banks are the cause of the crisis. We’re doing everyone a favor by sidelining them. A more stable financial system, who wouldn’t want that?

Secondly, by making the world enthusiastic about cryptocurrencies. It’s a huge gift for central banks and the IMF that the general public is getting accustomed to cryptocurrency. Apps are launched, payment cards introduced, and basic concepts explained. It becomes normal. It couldn’t be more synergetic to their own strategy.

Governments and regulators won’t show much enthusiasm and might even put up a fight. Partly for form’s sake, and partly because they want more regulation and legislation, preferably coordinated internationally. That said, the bottom line is that they have a big interest in adoption.

In closing

Governments, central banks and international organizations such as the IMF and the BIS are more concerned with cryptocurrency than you may suspect initially. Not just simply because they can’t ignore bitcoin and ICO’s anymore. Also because issuing their own cryptocurrency is in their own interest.

CBDC’s will certainly continue to be a topic of discussion within various economic institutes in the near future. They will emphasize the benefits of CBDC’s, such as a more stable financial system and fewer risks from commercial banks.

That’s why it’s crucial to stay alert for the less desired consequences that CBDC’s may have, such as limiting your personal freedom and privacy.

Central banks have a lot of power together with regulators and governments. They will certainly (try to) prevent cryptocurrencies from playing too big a role in the financial system. But if they want the general public to get used to cryptocurrencies, it could be very good news for your own cryptocurrency portfolio!

Iedereen heeft een mening

Onder de noemer Opinie schrijven we regelmatig over een spraakmakende podcast, video of tweetstorm.

We zijn het niet noodzakelijkerwijs eens met de spreker of schrijver, maar vinden het interessant genoeg om

te delen, duiden en ondertitelen.